Deducting Mileage on Your Tax Return

July 3, 2025

What Banks Don’t Tell You About Credit Cards

July 3, 2025Understanding How Dividends and Distributions Are Taxed from C-Corps and LLCs

Article compliments of FSMC Bookkeeping Services

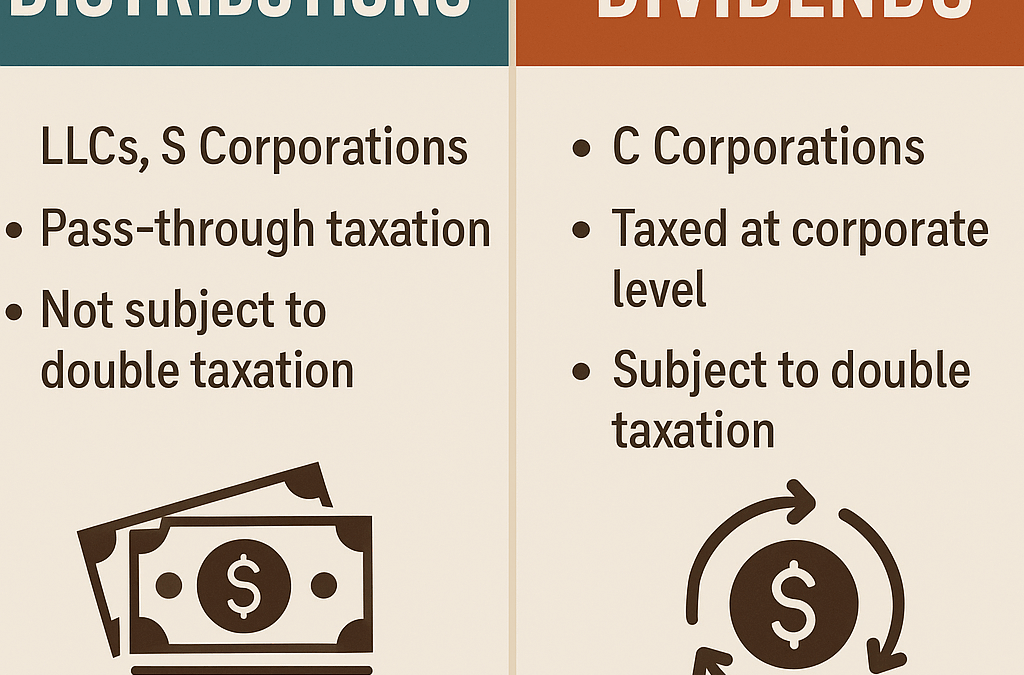

When business owners receive money from their companies—either through dividends or distributions—it’s important to understand how that money is taxed. Whether you’re a shareholder in a C-Corporation or a member of an LLC, the tax treatment of your income depends heavily on how the business is structured.

This guide breaks down the difference between dividends and distributions, how each is taxed, how they compare to earned income, and strategies you can implement to reduce your tax burden.

💼 What Are Dividends and Distributions?

Dividends are payments made by a C-Corporation to its shareholders from its after-tax profits. These are typically declared by the corporation’s board of directors and are usually paid in cash or additional stock.

Distributions, on the other hand, are payments made by an LLC or S-Corporation to its members or shareholders. These are generally returns of profit based on ownership percentage and are treated differently depending on the tax classification of the entity.

🧾 How Are Dividends Taxed?

Dividends from C-Corporations are subject to double taxation:

- The corporation pays corporate income tax on its profits.

- When those profits are distributed as dividends, the individual shareholders pay personal income tax on the dividends received.

There are two types of dividends:

- Qualified Dividends: Taxed at long-term capital gains rates (0%, 15%, or 20%) depending on your income level.

- Ordinary Dividends: Taxed at regular federal income tax rates.

⚠️ To qualify for the lower tax rate, the dividend must come from a U.S. corporation (or qualified foreign corporation), and the shareholder must meet a holding period requirement—generally 60+ days.

💰 How Are LLC Distributions Taxed?

LLCs are pass-through entities by default. This means the income generated by the business is passed through to the owners and taxed at their individual income tax rates—whether or not that income is actually distributed.

Here’s how it works:

- Single-Member LLCs are treated like sole proprietors. All business income is reported on Schedule C and taxed as ordinary income—including self-employment tax.

- Multi-Member LLCs are treated like partnerships by default. Members receive a Schedule K-1 reporting their share of income, which is taxed as passive income (unless they’re materially participating).

If the LLC elects to be taxed as an S-Corp, then:

- Owners are paid a reasonable salary (which is subject to payroll taxes), and

- Remaining profits can be distributed as dividends, which are not subject to self-employment tax.

👷 Dividends & Distributions vs. Earned Income

Earned income includes wages, salaries, and net earnings from self-employment. This type of income is subject to:

- Federal income tax

- State income tax (if applicable)

- Social Security and Medicare (FICA or SE tax)

Dividends and distributions, however, are typically not subject to payroll taxes, making them more tax-efficient in some cases.

Here’s a simple comparison:

| Type | Subject to SE or FICA Tax | Tax Rate | Source |

|---|---|---|---|

| Salary | ✅ Yes | Ordinary rates | Active work |

| Qualified Dividend | ❌ No | Capital gains rate | C-Corp profit distribution |

| LLC Distribution | ❌ or ✅ (varies) | Ordinary rates | Pass-through business income |

💡 Strategies to Minimize Taxes

- Use an S-Corp Election for LLCs

Electing to be taxed as an S-Corp allows you to split income into salary and distributions. This helps reduce self-employment taxes by taking a reasonable salary and receiving the rest as non-SE-taxed distributions. - Plan Qualified Dividends

Work with your accountant to ensure your dividends meet the qualified criteria to take advantage of capital gains rates. - Retain Earnings in a C-Corp (when appropriate)

Leaving money in the company avoids double taxation immediately—although this strategy must be used cautiously to avoid the Accumulated Earnings Tax. - Tax-Deferred Accounts

Consider reinvesting dividends into IRAs or 401(k)s when allowed. These funds grow tax-deferred or tax-free depending on the account type. - Track Basis in LLCs

Distributions in excess of your capital account basis can be taxed as capital gains. Maintaining accurate records ensures proper tax treatment.

❌ Common Misconceptions

“Dividends aren’t taxable if I reinvest them.”

False. Even if you reinvest dividends into more shares (like in a DRIP plan), they’re still taxable income in the year you receive them.

“LLC distributions aren’t taxed.”

Incorrect. Distributions themselves may not be taxed if you’ve already paid tax on the income, but the underlying profits are always taxable, whether you take a distribution or not.

“S-Corp distributions are tax-free.”

Not exactly. They are not subject to self-employment tax if you’ve paid yourself a reasonable salary, but they’re still subject to federal and state income taxes.

“I can avoid taxes by not taking a distribution.”

Nope. Pass-through entities report all profits to the IRS, whether or not cash was distributed. You’re taxed on your share, not your withdrawals.

📚 What Form Do You Receive?

Here’s how these payments are reported for tax purposes:

- Dividends (C-Corp): Reported on Form 1099-DIV

- LLC/S-Corp Distributions: Reported on Schedule K-1

- Earned Income: Reported on W-2 (for salaries) or Schedule C (for sole props)

🧾 Final Thoughts

Dividends and distributions offer significant opportunities for tax planning and financial growth—but they come with rules that must be followed closely. The key is understanding how your business is structured and what kind of income you’re receiving. Mixing up dividends, distributions, and earned income can result in incorrect filings or missed savings.

At FSMC Bookkeeping Services, we help business owners across the USA and Mexico navigate the complexities of small business finance, tax strategy, and compliance. Whether you’re an LLC member, S-Corp shareholder, or C-Corp investor, we ensure your books are clean, your reports are accurate, and your tax position is optimized.

📞 Ready to take control of your business finances?

Contact FSMC Bookkeeping Services today for expert guidance and personalized support.

#Dividends #LLCDistributions #SmallBusinessTaxes #FSMCBookkeeping #TaxPlanning #Ccorp #SCorp #TaxStrategy #BookkeepingHelp 💼🧾📊