5 Signs You Should Outsource Your Bookkeeping

August 6, 2025

S Corp vs. LLC: What’s Better for Tax Savings?

August 6, 2025

What to Do If You Receive a Notice from the IRS

Compliments of FSMC Bookkeeping Services | Serving the USA and Mexico

Receiving a letter or notice from the IRS can be alarming, especially if you’re unsure why it arrived. Whether you’re an individual taxpayer or a business owner, knowing how to respond calmly, quickly, and accurately can help you avoid penalties, interest, or further complications.

In this post, we’ll guide you through the essential steps you should take if you receive a notice from the IRS—and how FSMC Bookkeeping Services can support you every step of the way.

1. Don’t Panic—But Don’t Ignore It

The most important thing to remember is that an IRS notice is not always bad news. It could be anything from a simple request for additional information to a notification about a small discrepancy.

Ignoring a notice is the worst thing you can do. Inaction can result in increased penalties, interest, or enforced collection actions like wage garnishments or bank levies.

2. Read the IRS Notice Carefully

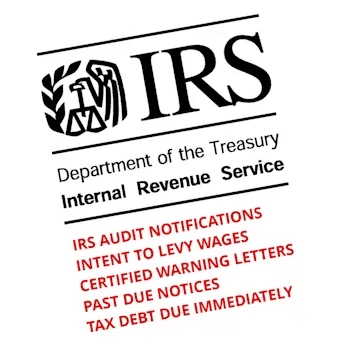

Each IRS notice includes a unique number (e.g., CP2000, CP501, Letter 226J) and explains:

- Why the IRS is contacting you

- What they need from you

- A deadline for response

- Any potential penalties

Understanding the issue is key. If it’s related to income discrepancies, missing returns, underpaid taxes, or documentation, the notice will clearly state it.

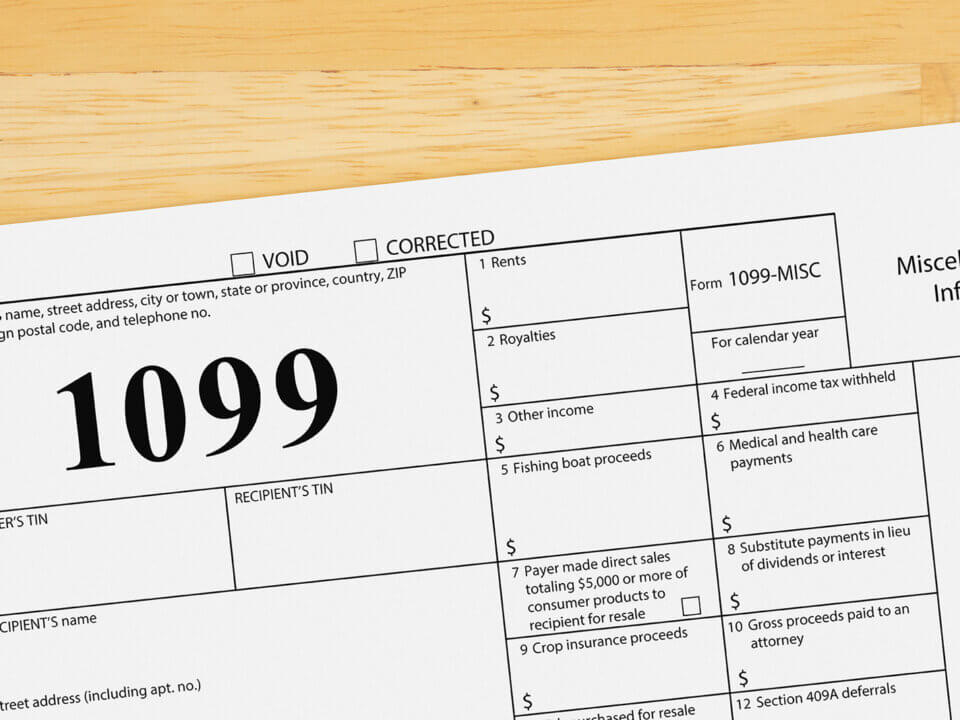

3. Verify the Accuracy

Before you take any action, compare the IRS’s information with your records. For example:

- Review your tax return

- Cross-check W-2s, 1099s, and other documents

- Ensure all your reported income is accurate

If it looks like a mistake, gather evidence to support your case. FSMC Bookkeeping Services can help you conduct a thorough review of your return and documents to identify and address discrepancies.

4. Respond by the Deadline

If the IRS requests a response, don’t miss the deadline. Late responses could mean:

- You lose your right to appeal

- Additional penalties are assessed

- Enforcement actions proceed

Your response may include:

- A signed verification form

- An explanation with documentation

- Payment arrangements

- A request for more time

FSMC can draft accurate, professional responses and communicate with the IRS on your behalf.

5. Know When to Dispute and When to Pay

Sometimes, the IRS is correct—and it’s simpler to pay the amount owed or set up a payment plan. But other times, there may be room for correction or appeal.

FSMC Bookkeeping Services specializes in tax resolution. Our team of CPAs, enrolled agents, and attorneys will evaluate your case and help you decide the best course of action:

- Accept the notice and pay if it’s accurate

- Dispute the notice if you believe it’s incorrect

- File an appeal for more complex cases

6. Beware of Scams

Real IRS notices arrive by U.S. Mail. The IRS does not initiate contact by phone, email, or social media.

If you receive a suspicious call or email claiming to be the IRS:

- Don’t provide personal information

- Report it to the IRS at phishing@irs.gov

- Contact FSMC for verification assistance

7. Set Up a Payment Plan if Needed

If the amount due is more than you can pay upfront, the IRS offers:

- Installment Agreements

- Offers in Compromise

- Currently Not Collectible (CNC) status

FSMC can help you navigate these programs, determine eligibility, and file the necessary paperwork.

8. Prevent Future Notices

IRS notices often stem from:

- Math errors

- Late filings

- Unreported income

- Payroll issues

- Mismatched 1099s or W-2s

Prevent future issues with professional bookkeeping and tax support. Our team ensures accurate filings, timely payments, and compliance with IRS regulations. FSMC also assists in tax planning so you stay ahead of potential problems.

9. Keep Records of Everything

If you receive a notice, maintain detailed records:

- IRS correspondence

- Your responses

- Documentation provided

- Proof of mailing or delivery

These records are essential in case of an audit, further notice, or legal appeal.

10. Let FSMC Bookkeeping Services Help You

At FSMC Bookkeeping Services, we work with individuals and businesses across the U.S. and Mexico. Our team includes:

✅ Certified QuickBooks Pro Advisors

✅ CPAs and tax experts

✅ Attorneys for IRS representation

✅ Consultants for business structure and compliance

Whether you’re facing a simple clarification or a full-scale tax problem, we’re here to help resolve it efficiently and affordably.

Final Thoughts

Receiving an IRS notice doesn’t have to be stressful when you know what to do and who to call. Read the letter carefully, respond on time, and seek professional help if needed.

FSMC Bookkeeping Services provides trusted tax resolution, bookkeeping, and compliance support across the USA and Mexico.

📞 Need help with an IRS notice?

Visit us at 👉 https://fsmcquickbooks.com/

Or contact us directly to schedule a confidential consultation.

Tags for SEO:

IRS notice, tax resolution help, bookkeeping USA and Mexico, FSMC Bookkeeping Services, IRS letters, tax help, tax compliance, bookkeeping firm, QuickBooks Pro Advisor, IRS CP2000, IRS penalties, IRS audit support

Would you like me to generate a featured image or SEO meta description for this post as well?