Payroll Tax: A Guide for Employers

June 1, 2025

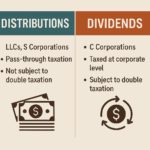

Understanding How Dividends and Distributions Are Taxed

July 3, 2025Everything You Need to Know About Deducting Mileage on Your Tax Return

Article compliments of FSMC Bookkeeping Services

If you use your vehicle for business purposes, you may be eligible to deduct mileage on your tax return. However, not every mile driven is deductible, and the IRS has clear guidelines on what qualifies and what doesn’t. At FSMC Bookkeeping Services, we want to help you understand the rules, avoid common mistakes, and ensure you’re maximizing your tax savings — the right way.

🚗 What Is the Mileage Deduction?

The mileage deduction allows business owners, freelancers, and certain employees to deduct the cost of using their personal vehicle for business purposes. Instead of deducting actual expenses (like fuel, oil, maintenance, and depreciation), many taxpayers opt to use the standard mileage rate set by the IRS each year.

For 2024, the IRS standard mileage rate is 67 cents per mile for business use.

✅ What Mileage Is Allowed?

To be deductible, your mileage must be ordinary and necessary for your business. Examples include:

- 🚘 Driving to meet clients or customers

- 🏢 Traveling between business locations

- 🛍️ Running business errands (like going to the bank, office supply store, post office, etc.)

- 🛫 Driving to and from the airport for a business trip

- 📦 Delivering products or materials to customers

If you’re self-employed or a business owner, you can deduct eligible business mileage on Schedule C of your personal tax return.

🚫 What Mileage Is Not Allowed?

Not all driving counts as deductible mileage — and this is where many taxpayers make mistakes.

Here’s what you cannot deduct:

- 🚫 Commuting mileage – Driving from your home to your main workplace and back is considered personal, not business.

- 🚫 Personal errands – Picking up groceries, taking your kids to school, or any other personal use of your car is non-deductible.

- 🚫 Unlogged miles – If you didn’t document it, you can’t deduct it.

- 🚫 Driving a company vehicle – If your employer owns the vehicle and pays for expenses, you can’t claim mileage for it.

📝 How to Track Your Mileage (The Right Way)

To qualify for the deduction, you must keep a detailed log of your business miles. The IRS requires that your log includes:

- 📅 The date of each trip

- 📍 The starting point and destination

- 🎯 The purpose of the trip

- 🔢 The miles driven

You can track mileage in several ways:

1. Manual Logbook

Use a notebook or spreadsheet to record your business miles each day.

2. Mileage Tracking Apps

Apps like MileIQ, Everlance, or QuickBooks Self-Employed automate tracking using GPS — making it easy and accurate.

3. Odometer Readings

Record your odometer at the beginning and end of the year, then use your detailed log to calculate business vs. personal use.

💡 Pro Tip: Don’t wait until tax time to start tracking. Keep up with your mileage daily or weekly to ensure accuracy.

🔍 Actual Expense Method vs. Standard Mileage Rate

While most taxpayers use the standard mileage rate, you also have the option to deduct actual vehicle expenses. This includes:

- Fuel

- Oil changes

- Maintenance & repairs

- Tires

- Insurance

- Registration fees

- Depreciation

You’ll still need to track your business-use percentage. For example, if 60% of your total miles driven were for business, you can deduct 60% of the actual costs.

⚠️ Important: Once you use the standard mileage rate for a vehicle the first year it’s in service, you must continue using it for that vehicle. You can’t switch to actual expenses later (unless the vehicle is leased).

❗ Common Misconceptions About Mileage Deductions

Let’s clear up a few myths:

❌ “I can deduct all miles driven during my workday.”

Wrong — only business-related trips qualify. Commuting doesn’t count.

❌ “I don’t need a log — I’ll just estimate at year-end.”

Big mistake. The IRS may disallow your deduction without proper documentation.

❌ “If I use my car 100% for business, I get the whole deduction.”

True — but only if it’s truly exclusively for business use, and you have solid proof.

❌ “I can deduct mileage to and from my home office.”

Only if your home office qualifies as your principal place of business under IRS guidelines. Otherwise, it’s considered commuting.

📉 What Happens If You’re Audited?

If you’re audited and can’t provide a detailed mileage log or supporting documentation, the IRS can deny your deduction entirely, even if the mileage was legitimate.

That’s why it’s crucial to track consistently, save your records, and work with a professional.

💼 How FSMC Bookkeeping Services Can Help

At FSMC Bookkeeping Services, we help small businesses, freelancers, and entrepreneurs across the USA and Mexico:

✅ Set up proper mileage tracking systems

✅ Choose between standard and actual expense methods

✅ Keep compliant records for tax time

✅ Maximize deductions while avoiding IRS red flags

Whether you need bookkeeping, accounting, or tax support, FSMC has the tools, knowledge, and personalized service to help you stay organized and audit-ready all year round.

🚀 Final Thoughts

Deducting mileage can be a powerful way to lower your taxable income — but only if you follow the rules. Stay organized, track your miles properly, and consult with a trusted bookkeeping and accounting partner to get the most out of every mile.

👉 Need help tracking mileage or cleaning up your books?

Contact FSMC Bookkeeping Services today for expert support you can count on.

📞 Serving clients across the USA & Mexico

📧 Visit us online to learn more and schedule a consultation!

#MileageDeduction #TaxTips #SmallBusinessHelp #BookkeepingServices #FSMCBookkeeping #VehicleExpenses #IRSCompliance #BusinessTravel #SelfEmployedTax 💼🚗🧾