5 Smart Business Resolutions for 2026

December 18, 2025What You Need to Start a New Business: A Complete Guide for New Entrepreneurs

Compliments of FSMC Bookkeeping Services

Starting a new business is exciting—but it’s also complex. Beyond a great idea, success depends on making smart decisions around structure, taxes, compliance, staffing, and financial management from day one. Skipping these fundamentals can lead to costly mistakes later.

This guide walks through what is needed to start a new business, including organizational structures, tax considerations, staffing decisions, registrations, sales tax obligations, and why professional accounting and bookkeeping support is essential—even in the earliest stages. For best practices, this article aligns with the guidance and services offered by FSMC Bookkeeping Services at fsmcquickbooks.com.

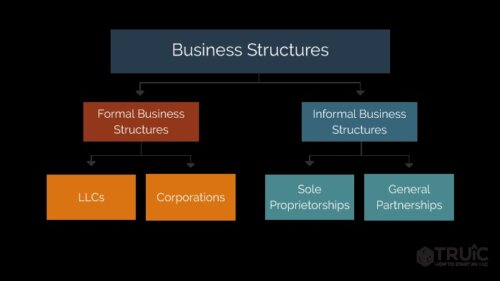

Choosing the Right Business Structure

One of the first and most important decisions is selecting a legal structure. Your choice affects taxes, liability, compliance requirements, and growth flexibility.

Sole Proprietorship

A sole proprietorship is the simplest structure and often used by freelancers or solo consultants.

Taxation

-

Business income is reported on your personal tax return

-

Subject to income tax and self-employment tax

Pros

-

Easy and inexpensive to start

-

Minimal regulatory requirements

Cons

-

No legal separation between personal and business assets

-

Higher personal risk exposure

Partnership (General or Limited)

Partnerships involve two or more owners sharing profits, losses, and responsibilities.

Taxation

-

Pass-through taxation

-

Each partner reports income on their personal return

Pros

-

Shared capital and expertise

-

Flexible management

Cons

-

Partners may be personally liable

-

Requires a well-drafted partnership agreement

Limited Liability Company (LLC)

LLCs are one of the most popular structures for small and medium-sized businesses.

Taxation

-

Default pass-through taxation

-

Can elect to be taxed as an S Corporation or C Corporation

Pros

-

Personal asset protection

-

Flexible tax treatment

-

Relatively simple compliance

Cons

-

State fees and reporting requirements

-

Varies by state

Corporation (C Corp and S Corp)

Corporations are more formal entities designed for scalability.

C Corporation Taxation

-

Pays corporate income tax

-

Shareholders pay tax again on dividends

S Corporation Taxation

-

Pass-through taxation

-

Payroll requirements for owner compensation

Pros

-

Strong liability protection

-

Easier access to investors

Cons

-

More complex administration

-

Increased compliance and reporting

Registering Your Business: State and Federal Requirements

Once your structure is chosen, registration is essential.

Once your structure is chosen, registration is essential.

Federal Registration

Most businesses must obtain an Employer Identification Number (EIN) from the Internal Revenue Service. This is required to:

-

Open business bank accounts

-

File tax returns

-

Hire employees

State Registration

Depending on your location, you may need to:

-

Register with the Secretary of State

-

Obtain state tax IDs

-

Apply for industry-specific licenses or permits

Failing to register properly can delay operations or trigger penalties.

Employees vs. Independent Contractors

Staffing decisions affect taxes, compliance, and cash flow.

W-2 Employees

Employees are integral to long-term growth but come with obligations.

Employer Responsibilities

-

Payroll tax withholding

-

Employer-paid Social Security and Medicare

-

Unemployment insurance

-

Workers’ compensation coverage

Best For

-

Core operational roles

-

Long-term positions

1099 Independent Contractors

Contractors offer flexibility and lower upfront costs.

Key Considerations

-

No payroll tax withholding

-

Must meet legal contractor classification standards

-

Misclassification penalties can be severe

Best For

-

Project-based work

-

Specialized services

Many businesses use a hybrid approach—contractors early on, transitioning to employees as revenue stabilizes.

Sales Tax: Collection and Compliance

If you sell taxable goods or services, sales tax compliance is critical.

Registration

You may need to:

-

Register with your state’s Department of Revenue

-

Obtain a sales tax permit

Ongoing Obligations

-

Collect sales tax at the point of sale

-

File monthly, quarterly, or annual returns

-

Remit collected taxes on time

Sales tax rules vary by state and product type, making professional guidance invaluable.

Hiring and Building Your Team

Finding the right people is about more than filling roles.

Where to Find Talent

-

Professional networking platforms

-

Industry job boards

-

Referrals and local business groups

Hiring Best Practices

-

Clearly define job roles and expectations

-

Use structured interview processes

-

Perform background and reference checks

As your business grows, formal HR policies and employee handbooks become essential.

Legal and Accounting Support: Not Optional

Many new business owners delay professional support to save money—often at great cost later.

Legal Counsel

A business attorney can help with:

-

Entity formation

-

Contracts and agreements

-

Compliance and risk management

Accounting and Tax Professionals

Professional accountants help ensure:

-

Proper entity setup

-

Accurate tax filings

-

Strategic tax planning

Early guidance prevents errors that become expensive to unwind.

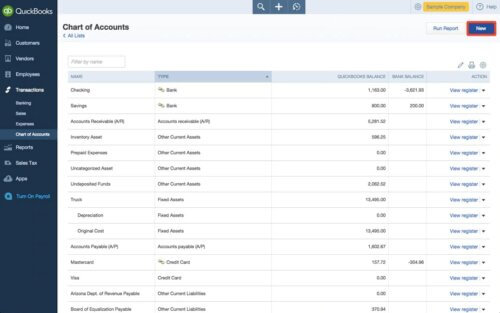

Why a Bookkeeper Is Valuable from Day One

Bookkeeping is often underestimated—but it’s foundational.

What a Bookkeeper Does

-

Tracks income and expenses

-

Manages accounts payable and receivable

-

Reconciles bank and credit card accounts

-

Supports payroll and tax preparation

Benefits for New Businesses

-

Real-time financial visibility

-

Clean records for tax compliance

-

Better cash flow management

- Data-driven decision making

Using cloud-based platforms like QuickBooks, professional bookkeeping services—such as those offered by FSMC Bookkeeping Services—help business owners stay organized, compliant, and focused on growth.

Final Thoughts: Build It Right from the Start

Starting a new business requires more than passion—it demands structure, compliance, and financial discipline. Choosing the right entity, registering properly, understanding taxes, hiring correctly, and investing in professional support sets the foundation for long-term success.

Whether you’re launching a startup or transitioning from a side hustle into a full-time operation, working with experienced bookkeeping and accounting professionals ensures you build your business the right way—accurately, compliantly, and strategically—from day one.

For expert guidance, bookkeeping support, and QuickBooks-based financial systems tailored to new businesses, visit fsmcquickbooks.com.

#StartANewBusiness #SmallBusinessStartup #BusinessFormation #BusinessStructure #LLCvsCorporation #EntrepreneurTips #NewBusinessOwner #BusinessTaxes #StartupAccounting #BookkeepingServices #QuickBooksExpert #SalesTaxCompliance #HireEmployees #IndependentContractors #SmallBusinessAccounting #BusinessCompliance #EntrepreneurLife #FSMCBookkeeping