Succession Planning Guide for Business Owners

May 2, 2025

Financial Metrics Every Small Business Should Track

June 1, 2025Trusts vs. Wills

What’s the Difference and Which Do You Need?

Planning for the future is one of the most responsible steps you can take to protect your assets, support your loved ones, and ensure your wishes are honored after your passing. Two of the most common estate planning tools are wills and trusts, but many people don’t fully understand how they differ, when to use each, or whether they need both.

This blog post will provide a comprehensive, SEO-optimized guide to the differences between wills and trusts, how each is used, real-life use case scenarios, and the legal and financial implications of not having either in place.

What Is a Will?

A will is a legal document that expresses how a person wants their property, assets, and personal matters handled after death. It only becomes active upon the death of the person who created it (the testator).

A will is a legal document that expresses how a person wants their property, assets, and personal matters handled after death. It only becomes active upon the death of the person who created it (the testator).

Key Features of a Will:

- Names beneficiaries of your estate

- Appoints guardians for minor children

- Designates an executor to carry out your wishes

- Can include instructions for funeral arrangements

- Goes through probate, a public court process to validate the will

What Is a Trust?

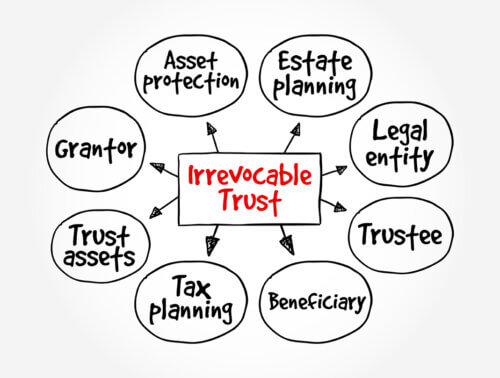

A trust is a legal arrangement that allows a third party (the trustee) to hold and manage assets on behalf of a beneficiary. Trusts can be created during a person’s lifetime (living trusts) or after death (testamentary trusts).

A trust is a legal arrangement that allows a third party (the trustee) to hold and manage assets on behalf of a beneficiary. Trusts can be created during a person’s lifetime (living trusts) or after death (testamentary trusts).

Key Features of a Trust:

- Can go into effect during your lifetime (revocable or irrevocable)

- Avoids probate (for living trusts)

- Offers greater privacy and control

- Can protect assets from creditors or lawsuits

- Allows for conditional asset distribution (e.g., age-based, milestones)

Use Case Scenarios

Scenario 1: Using a Will

Maria, a single mother of two minor children, wants to ensure her assets go to her kids and that a guardian is named for them if she passes.

- She creates a will that names her children as beneficiaries.

- She appoints her sister as the guardian and designates a trusted family member as executor.

- Her will is filed after her death, goes through probate, and her estate is distributed according to her wishes.

Best for: Individuals with modest estates and simple distribution wishes who need to designate guardians for minor children.

Scenario 2: Using a Trust

James and Linda are a married couple with significant real estate holdings and investments. They want to avoid probate and maintain privacy over their estate.

- They set up a revocable living trust, transferring ownership of their home and investments into the trust.

- James and Linda serve as trustors and trustees while alive, managing their own assets.

- Upon their death, a successor trustee takes over and distributes assets to beneficiaries without going through probate.

Best for: Individuals or families with high-value assets, complex financial situations, or privacy concerns.

What Happens Without a Will or Trust?

Failing to have a valid estate plan can create serious complications:

- Intestacy Laws: The state determines who inherits your property, which may not align with your wishes.

- No Guardian Named: The court chooses who cares for your minor children.

- Lengthy Probate: Assets may be tied up in probate court for months or even years.

- Family Disputes: Without clear instructions, conflicts among surviving relatives are more likely.

Trusts: Short-Term Restrictions and Considerations

Newly established trusts may face the following short-term limitations:

- Asset Funding: Simply creating a trust isn’t enough — assets must be legally transferred into the trust, which takes time and proper documentation.

- Revocable Trusts Can Be Amended: This flexibility is useful but can cause confusion if not updated consistently.

- Irrevocable Trusts Cannot Be Changed: These offer tax and asset protection advantages, but once created, the trustor relinquishes control.

- Initial Costs and Legal Fees: Setting up a trust may require more legal support and upfront cost than a will.

Do You Need Both a Will and a Trust?

In many cases, the answer is yes. A well-rounded estate plan often includes both:

- A will ensures that any assets not included in your trust (called the “pour-over will”) are still distributed according to your wishes.

- A trust provides asset protection, avoids probate, and ensures continuity of management in the event of incapacity.

Having both documents creates a safety net, ensuring that no part of your estate is left to chance.

How to Choose an Executor or Administrator (For a Will)

The executor is responsible for managing the estate, paying debts, and distributing assets. Choose someone who is:

- Trustworthy and responsible

- Detail-oriented and organized

- Able to manage complex tasks or seek professional help

- Willing and able to serve

Consider naming a backup executor in case your first choice is unable to serve.

How to Choose a Trustor and Trustee (For a Trust)

- Trustor (also called Grantor or Settlor): The person who creates the trust and contributes the assets. This is usually you.

- Trustee: The person or entity (like a bank or attorney) responsible for managing the trust according to your instructions.

Choosing a Trustee:

- Look for someone financially savvy, trustworthy, and impartial

- Professional trustees can help manage complex estates

- Always name a successor trustee in case the original is unable or unwilling to serve

Key Differences Between Wills and Trusts

| Feature | Will | Trust |

| Takes Effect | After death | Can be during life or after death |

| Probate | Required | Avoided (if funded properly) |

| Privacy | Public record | Private document |

| Guardianship for minors | Can designate | Not applicable |

| Asset management during incapacity | Not applicable | Trustee can manage assets |

| Cost | Generally less expensive | Higher setup cost but more benefits |

Final Thoughts: Wills vs. Trusts in Estate Planning

Both wills and trusts play vital roles in a comprehensive estate plan. The best approach depends on your financial situation, family dynamics, goals, and the complexity of your estate.

If you’re just starting your estate planning journey, a will might be enough. However, if you want to avoid probate, protect your assets, and control how and when your heirs receive your wealth, a trust is a powerful tool.

For many individuals and families, using both provides the most complete protection and peace of mind.

Let FSMC Bookkeeping Services Help

At FSMC Bookkeeping Services, we support clients in the USA and Mexico with personalized financial and estate planning solutions. Our team of partner attorneys and notarios help you organize your financial life and work with your legal advisors to ensure your estate planning tools — wills, trusts, powers of attorney, and more — are aligned with your long-term goals.