Estate Taxes Explained: What You Need to Know

October 4, 2025

Budgeting for Growth: How Accountants Help Small Businesses Scale with Confidence

November 3, 2025Property Taxes: What Every Homeowner Needs to Know

By: FSMC Bookkeeping Services

Property taxes are a reality for every homeowner, and in many areas of the U.S., they’re on the rise. The good news? With the right knowledge, you may be able to cut costs and keep more money in your pocket.

Here’s a straightforward look at how property taxes are calculated, plus actionable ways you can potentially reduce your bill.

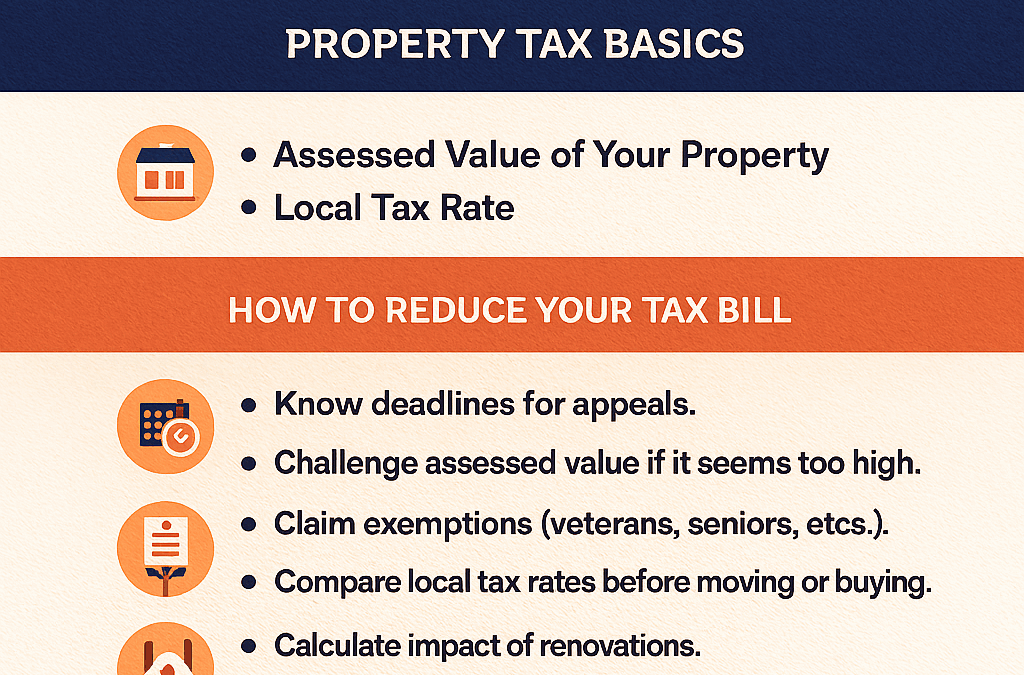

How Property Taxes Are Calculated

Your property tax bill comes down to two main factors:

-

The assessed value of your home – determined by your local assessor.

-

The local tax rate – set by city, county, school districts, and other local authorities.

👉 Even if your home’s market value doesn’t change, your tax bill can increase if local governments raise rates. While tax rates are set through legislation, your home’s assessed value often involves subjective judgment.

6 Ways to Lower Your Property Tax Bill

1. Stay Ahead of Deadlines

Appealing your property’s assessed value requires strict timing. Learn the process in your area and mark important appeal deadlines on your calendar—missing them could mean waiting an entire year.

2. Challenge the Assessment

If you think your property is valued too high, file a formal appeal. Gather evidence such as recent sales of comparable homes or proof that your home is in less-than-perfect condition. Be prepared: the appeal window is often only a few weeks.

3. Claim Available Exemptions

Many states and counties offer property tax exemptions. You might qualify if you are a veteran, senior, disabled, low-income homeowner, or live in a historic district or disaster zone. Check with your assessor’s office to see what’s available.

4. Compare Local Tax Rates Before Buying

Two identical houses just miles apart can come with drastically different property tax bills. Always research local tax histories before buying or moving—knowing how rates have changed over the years can help you avoid surprises.

5. Weigh the Tax Impact of Renovations

Home improvements like adding a deck, finishing a basement, or renovating a kitchen can raise your assessed value. In many areas, pulling a permit triggers a reassessment. Factor in possible long-term tax costs before diving into a remodel.

6. Review Your Lot Details

Your tax bill includes the value of your land, not just your home. If parts of your property are unusable (wetlands, steep slopes, easements), ask your assessor about an adjustment to lower your bill.

Final Word

Property taxes aren’t set in stone—you have options to question and potentially reduce them. The key is understanding how the system works, staying organized with deadlines, and being proactive about exemptions or appeals.

A little preparation could translate into big savings.

Ready to Take Control of Your Property Taxes?

At FSMC Bookkeeping Services, we help homeowners and business owners identify tax-saving opportunities and stay ahead of financial surprises.

📅 Schedule your free consultation today and let us guide you through smart tax strategies that keep more money in your pocket.

👉 Book Your Free Consultation with FSMC Bookkeeping Services

#PropertyTaxes #HomeownerTips #SaveMoney #RealEstate #TaxSavings