Top 5 Tax Relief Strategies for Businesses Affected by Natural Disasters

January 20, 2025

When Should You File Your Taxes Early?

February 9, 2025IRA Taxes: Rules to Know and Understand

IRAs offer significant tax benefits, but breaking the rules can have serious financial consequences. Understanding these rules can help you avoid common tax pitfalls and maximize your retirement savings.

Individual Retirement Accounts (IRAs) provide a valuable way to save for retirement while enjoying tax advantages. The two most common types are the traditional IRA, which allows for tax-deferred growth and potential up-front deductions, and the Roth IRA, which offers tax-free withdrawals in retirement.

To make the most of your IRA and avoid costly penalties, it’s important to be aware of key tax rules. Here are some common pitfalls categorized into five areas:

- Contribution and income limits

- Investment and transaction rules

- Withdrawal rules

- Rollover and conversion rules

- Estate and inheritance rules

Note that these rules pertain to federal tax laws—state tax treatment may differ.

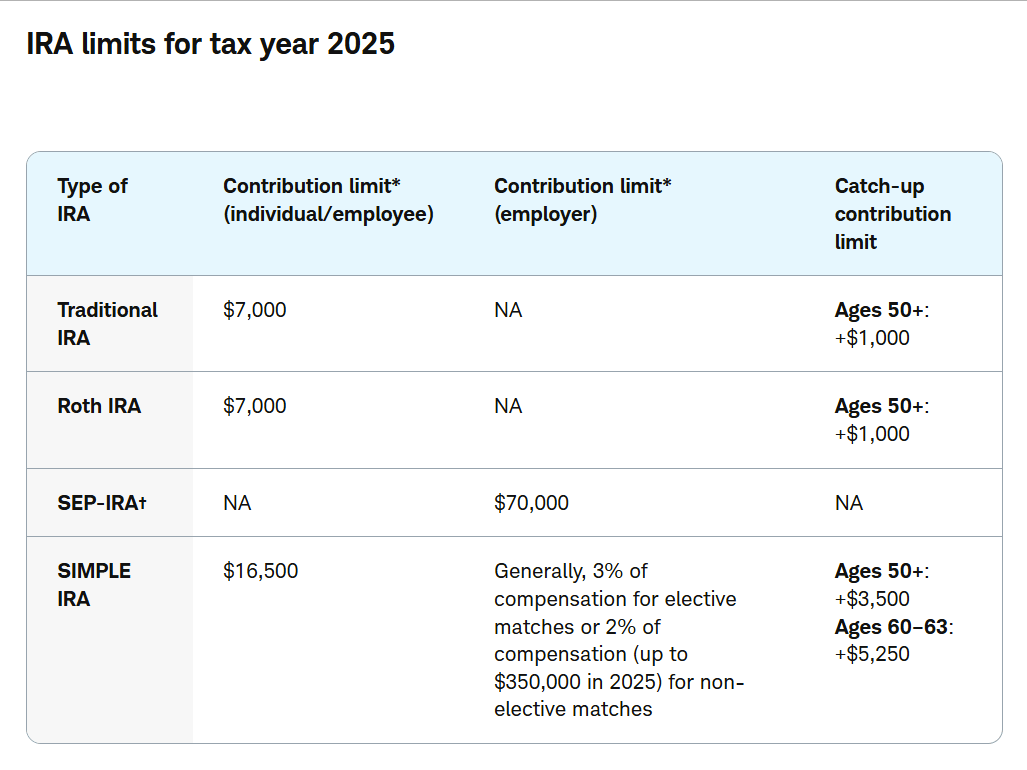

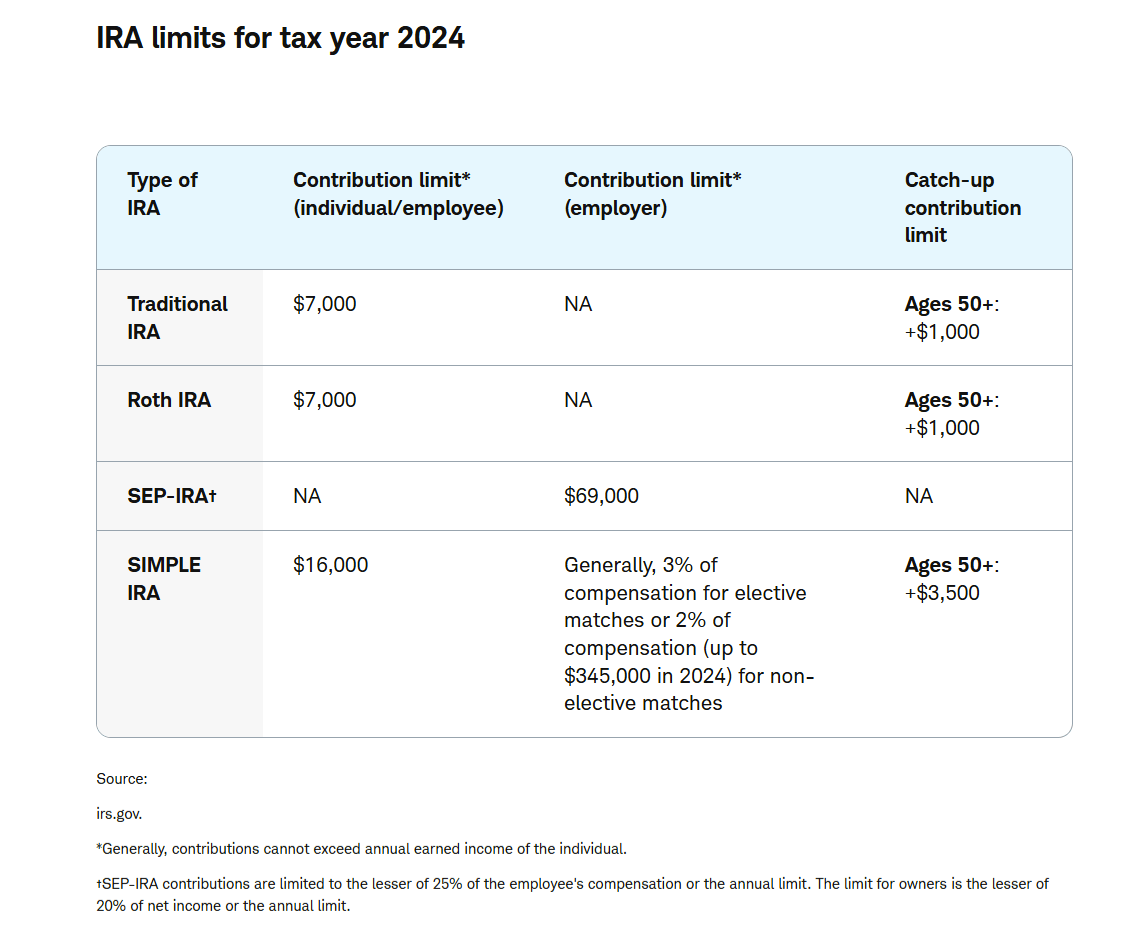

1. IRA Contributions and Income Limits

While saving for retirement is crucial, contributing beyond allowed limits can result in penalties. Contribution limits vary by IRA type, and some have income restrictions. High-income earners may be unable to contribute directly to a Roth IRA, but there are legal strategies to fund one indirectly.

For self-employed individuals using a SEP IRA, contributions are based on net earnings. Understanding these rules is vital to avoid excess contributions, which are subject to a 6% penalty per year until corrected.

2. IRA Investment and Transaction Rules

IRA investments are subject to restrictions. Prohibited investments include collectibles such as artwork, antiques, and most metals, with a few exceptions like certain U.S. Treasury-minted coins and bullion.

Additionally, IRA holders must avoid prohibited transactions, such as:

- Borrowing from the IRA

- Selling property to the IRA

- Using the IRA as collateral for a loan

- Purchasing property for personal use

Violating these rules can result in the entire account being treated as a taxable distribution.

3. IRA Withdrawal Rules

Withdrawing funds from an IRA at the wrong time can lead to penalties. Generally, early withdrawals (before age 59½) are subject to a 10% penalty in addition to regular income tax. However, exceptions exist, including withdrawals for medical expenses, first-time home purchases, and certain educational costs.

Once you reach age 73, required minimum distributions (RMDs) must be taken from traditional IRAs. Failing to take RMDs results in a penalty of up to 25% of the amount not withdrawn.

Learn more about withdrawal rules at the IRS website

4. IRA Rollover and Conversion Rules

IRA rollovers and conversions allow funds to be transferred between accounts, but incorrect handling can trigger taxes.

- Indirect rollovers (where funds are withdrawn and re-deposited within 60 days) are limited to one per year. Failure to meet the deadline results in taxation and potential penalties.

- Direct rollovers (trustee-to-trustee transfers) are preferable to avoid taxes and penalties.

- Roth IRA conversions allow funds from traditional IRAs to be converted, offering tax-free growth. However, the conversion is taxable in the year it occurs and can push you into a higher tax bracket.

5. Estate and Inheritance Rules

IRA tax considerations don’t end at retirement—planning for your beneficiaries is essential. Ensuring the correct beneficiary designations are in place is crucial, as these supersede wills.

Beneficiaries must follow specific withdrawal rules, and a misstep can result in unnecessary taxation. Certain beneficiaries may be able to stretch distributions over time to maximize tax advantages.

Final Thoughts

These accounts are a critical part of retirement planning, and understanding tax rules can help you avoid unnecessary penalties while maximizing savings. FSMC Bookkeeping Services is here to provide expert guidance on IRA tax strategies and other financial planning matters. Reach out to our team for professional assistance in navigating tax regulations and ensuring compliance with IRS rules.